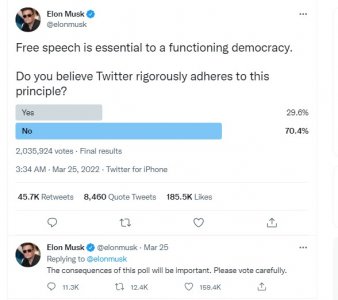

So Elon Musk bought a lot of Twitter stock, which not only caused the stock price to rise, it gave him a 9.2% stake.

Elon Musk becomes Twitter's biggest shareholder with 9.2% stake

From the related articles I'm reading, this appears to be a bigger deal than I thought it was. 9.2% is a significant share, but isn't there like 90% more stock still out there? Why is this such a big deal--does less than 10% total stock / votes give you that much leverage over a company? Asking because I don't understand how this works.

Elon Musk becomes Twitter's biggest shareholder with 9.2% stake

From the related articles I'm reading, this appears to be a bigger deal than I thought it was. 9.2% is a significant share, but isn't there like 90% more stock still out there? Why is this such a big deal--does less than 10% total stock / votes give you that much leverage over a company? Asking because I don't understand how this works.