So, in a few threads, @lindy and I have been talking about the market. Since then, I've had a few people hit me up about various trading strategies in PMs. So, in the same vein as the Food Thread, I thought I'd start a thread about trading the stock market.

To start with, who here trades? What type of trading, Buy and Hold, Swing trader/day trader or pattern day trader? What do you trade, Options, Equities, ETF/ETNs or Futures? Are you in a particular sector or just whatever feels good at the time? Do you have any particular mechanical trading strategies (don't give away the farm, just the general gist so we know how you trade). Are you a technical trader or fundamentals trader? How long have you been trading? Do you have any good resources that you use to help pick stocks or strategies? What's your biggest challenge?

For me, I started day trading a small account in July (not counting paper trading). At one time in the past, I developed the algorithmic trading for a large bank. I'm trying to leverage what I learned back then to make some money for myself now. I trade monthly Options and ETFs. I've dropped off options for the most part. They can provide small steady income but I'm too impatient to sit around for a month to make a couple of dollars. Now I'm almost exclusively trading a higher risk, higher reward mechanical ETF day trade strategy that I developed around gold ETFs. So far so good.

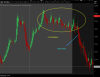

I'm absolutely a technical trader. I don't care about any of the fundamentals or even the price. I'm just looking for a good trend reversal and diving in to make a few bucks. I use Heiken Ashi charts and candlestick patterns as my primary tools.

The biggest challenge I face right now is the small size of my account. Between having to beat the commissions and fees and having restrictions around the number of day trades I can do, it's tough to make a good profit.

Some of the better resources I've found are:

Bloomberg - News and black swan events

Zack's - Stock screening and trading ideas

Tasty Trade You Tube Channel - Options trading strategies for small accounts (look for tasty bites videos)

Trade King - Basic option strategies

@lindy I finally got out of that gold trade I said went bad at a .48/share profit

To start with, who here trades? What type of trading, Buy and Hold, Swing trader/day trader or pattern day trader? What do you trade, Options, Equities, ETF/ETNs or Futures? Are you in a particular sector or just whatever feels good at the time? Do you have any particular mechanical trading strategies (don't give away the farm, just the general gist so we know how you trade). Are you a technical trader or fundamentals trader? How long have you been trading? Do you have any good resources that you use to help pick stocks or strategies? What's your biggest challenge?

For me, I started day trading a small account in July (not counting paper trading). At one time in the past, I developed the algorithmic trading for a large bank. I'm trying to leverage what I learned back then to make some money for myself now. I trade monthly Options and ETFs. I've dropped off options for the most part. They can provide small steady income but I'm too impatient to sit around for a month to make a couple of dollars. Now I'm almost exclusively trading a higher risk, higher reward mechanical ETF day trade strategy that I developed around gold ETFs. So far so good.

I'm absolutely a technical trader. I don't care about any of the fundamentals or even the price. I'm just looking for a good trend reversal and diving in to make a few bucks. I use Heiken Ashi charts and candlestick patterns as my primary tools.

The biggest challenge I face right now is the small size of my account. Between having to beat the commissions and fees and having restrictions around the number of day trades I can do, it's tough to make a good profit.

Some of the better resources I've found are:

Bloomberg - News and black swan events

Zack's - Stock screening and trading ideas

Tasty Trade You Tube Channel - Options trading strategies for small accounts (look for tasty bites videos)

Trade King - Basic option strategies

@lindy I finally got out of that gold trade I said went bad at a .48/share profit